(321) 462-4141

Call Us Now

- How It Works

- Why CoolNow

- Services

- No Credit Check Air Conditioning Financing | Discover $0 down HVAC Financing

- HVAC Financing | Easy AC Financing with $0 Down

- Air Conditioning Financing with Bad Credit | Affordable AC Financing, No Credit Needed

- Air Conditioning Financing | Get Approved in minutes, No Credit Check, $0 Down

- Best HVAC Financing Company in Florida | Affordable AC Financing with $0 down, Low Payments and Next-Day Installation

- AC Replacement Financing | Affordable AC Financing, No Credit Check

- Resources

Beat the Heat Without Breaking the Bank: Your Guide Air Conditioning Financing

Table of Contents

ToggleSpoiler: You don’t need a fat savings account or a flawless credit score to enjoy a cool home in Florida. You just need to know your HVAC financing options—and how to spot the ones that won’t trap you in high-interest, fine-print drama.

At CoolNow™, we believe staying cool should be easy, affordable, and stress-free. So this isn’t a pitch—this is a real-world guide to help you understand the ins and outs of air conditioning financing and feel confident making the next move.

Understanding Air Conditioning Financing

Air conditioning financing refers to various payment plans and loan options that allow homeowners to purchase and install AC systems without paying the full amount upfront. These financing options can include:

Personal Loans: Unsecured loans from banks or online lenders.

Home Equity Loans or HELOCs: Loans secured against your home’s equity.

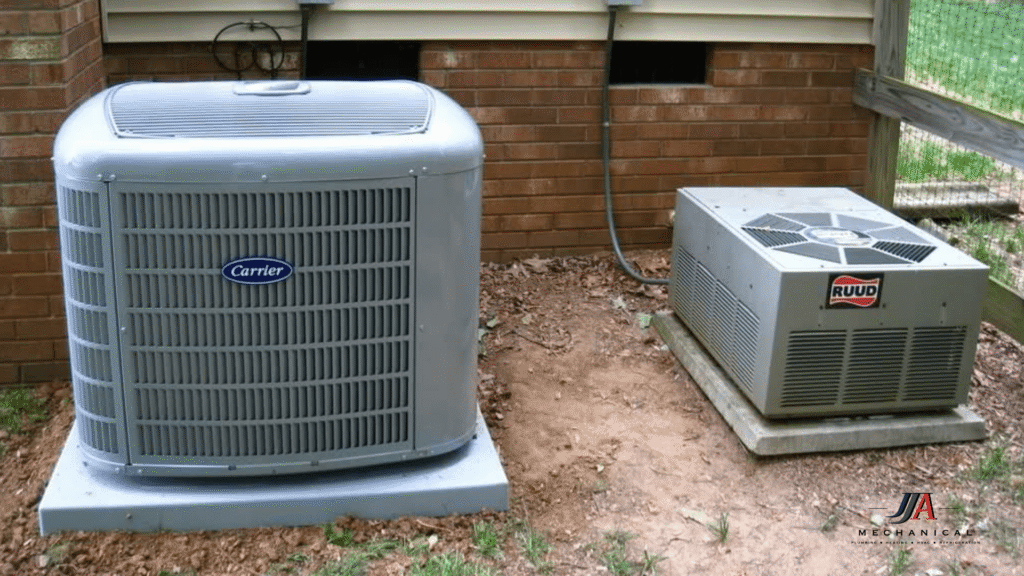

Manufacturer Financing: Financing plans offered by AC manufacturers like Trane or Carrier.

Retailer Financing: Options provided by retailers such as Lowe’s.

In-House Financing: Payment plans offered directly by HVAC service providers.Lowe’s

These options make AC financing accessible to a wide range of homeowners, regardless of their financial situation.

Why HVAC Systems Are So Expensive (and What You’re Actually Paying For)

Let’s rip the band-aid off: A new HVAC system can cost anywhere between $5,500 and $15,000. The exact number depends on your home’s size, layout, ductwork, energy efficiency needs, and brand preferences.

Here’s what’s packed into that price tag:

Equipment (unit, coils, air handler, etc.)

Labor and installation

Permits and local code compliance

Warranty and post-install support

Possibly ductwork upgrades or smart thermostat add-ons

If you weren’t expecting to drop five figures on cooling your home, you’re not alone. Most homeowners don’t budget for their AC to suddenly die. That’s where Air Conditioning financing comes in.

What is HVAC Financing, Anyway?

HVAC financing lets you spread out the cost of a new system into affordable monthly payments, instead of paying everything upfront.

Just like buying a car or a new iPhone, financing your AC unit gives you the power to:

Replace your system quickly (when waiting isn’t an option)

Choose a higher-efficiency unit (which can save you money long-term)

Avoid high-interest credit cards or payday loans

But here’s the trick: Not all financing is created equal. That’s why we put together this guide—so you don’t get stuck in a bad deal disguised as a “solution.”

Is It Smart to Finance an HVAC System?

Great question—and we’re not afraid to answer it honestly.

Financing is smart when:

Your system fails unexpectedly and you need a fast solution

You want to conserve your savings for emergencies

You qualify for low- or no-interest terms

You’re improving your home’s energy efficiency (and monthly bills)

Financing is not smart when:

The interest rate is higher than your thermostat setting

There are hidden fees, penalties, or early payoff traps

You’re working with a lender that doesn’t understand HVAC systems

You’re pushed into it without fully understanding your options

👉 That’s why we recommend working directly with licensed HVAC companies that offer their own financing programs—like CoolNow™. We’re HVAC specialists, not just salespeople, so we’ll never recommend a system you don’t need or a plan that doesn’t make sense for your budget.

How Do HVAC Payment Plans Work?

HVAC financing usually comes in a few flavors:

0% interest plans (for a limited time—typically 6 to 24 months)

Low-interest extended plans (36, 60, or 72 months)

Deferred payments (start paying later, usually after installation)

No credit check financing (like we offer at CoolNow™)

✅ With CoolNow™ Financing, you can:

Apply in under 60 seconds

Skip the credit check

Get approved same day

Schedule installation as early as tomorrow

We built this program because we saw too many good people getting stuck with bad options. It’s our way of making HVAC more human.

What to Look for in a Good HVAC Financing Plan?

When shopping around, make sure you ask these questions:

Is there a credit check?

What’s the APR (Annual Percentage Rate)?

Are there penalties for paying off early?

Is the quote final, or are there surprise fees later?

Will this company actually do the install, or are they just reselling the loan?

If you’re not getting clear answers—or worse, you’re getting pressure instead of help—walk away. Transparency is a non-negotiable when it comes to financing.

Who Offers HVAC Financing?

You’ve got a few options:

🔹 Big Retailers (e.g., Home Depot, Lowe’s)

They usually offer third-party financing, but it’s rarely tailored to your home—and they subcontract installations, so you may not know who’s actually doing the work.

🔹 Banks & Credit Unions

These offer personal loans or home equity lines, but require good credit, income verification, and paperwork. Not ideal for urgent installs.

🔹 HVAC Contractors with In-House Financing (👋 Hey, that’s us)

Companies like ClimaCore offering CoolNow™ provide streamlined options without third-party headaches. We handle everything—financing, install, service—under one roof.

Bonus: Do I Qualify for HVAC Rebates or Tax Credits?

Yes—if you play your (cool) cards right.

The government offers energy-efficient financing programs for HVAC systems like the Florida PACE Program (Property Assessed Clean Energy), a financing mechanism that allows homeowners and businesses to fund energy efficiency, renewable energy, and hurricane protection improvements by adding the cost to their property tax bill, rather than taking on a traditional loan.

Property owners enter into a voluntary agreement with a PACE provider to finance eligible projects.

At CoolNow™ we help our customers understand what incentives they qualify for based on their location, system, and budget.

👉 Talk to a CoolNow Rep. here and we’ll walk you through the process—no fluff.

Final Takeaway: You Deserve to Be Comfortable—Without Drowning in Debt

We know how intimidating “HVAC financing” sounds. Investing in a new air conditioning system is an investment in your comfort, health, and home’s value. While the upfront cost can seem daunting, various air conditioning financing options are available to make this essential purchase more manageable. By understanding your needs, exploring different financing avenues, and following our smart tips, you can find a solution that fits your budget and allows you to enjoy a cool and comfortable home for years to come.

But when done right, it’s a smart, stress-free way to upgrade your home and live comfortably—even during Florida’s most brutal months.

CoolNow is your trusted partner in providing not only exceptional HVAC services but also reliable and affordable ac financing solutions. Contact us today to learn more and take the first step towards a cooler, more comfortable future!

Whether you need a new unit yesterday, or you’re just planning ahead—we’re not here to push you. We’re here to give you the tools and real talk you need to make the best decision for your home, your family, and your budget.

👉 Check out CoolNow Financing Options: