(321) 462-4141

Call Us Now

- How It Works

- Why CoolNow

- Services

- No Credit Check Air Conditioning Financing | Discover $0 down HVAC Financing

- HVAC Financing | Easy AC Financing with $0 Down

- Air Conditioning Financing with Bad Credit | Affordable AC Financing, No Credit Needed

- Air Conditioning Financing | Get Approved in minutes, No Credit Check, $0 Down

- Best HVAC Financing Company in Florida | Affordable AC Financing with $0 down, Low Payments and Next-Day Installation

- AC Replacement Financing | Affordable AC Financing, No Credit Check

- Resources

What Just Happened: A Quick Breakdown

Table of Contents

ToggleWhat’s Going On With Buy Now, Pay Later (BNPL)?

On May 6, 2025, the Consumer Financial Protection Bureau (CFPB), under new Trump-era leadership, quietly dropped plans to regulate Buy Now Pay Later (BNPL) services as traditional credit products. The announcement sent shockwaves through both the fintech world and consumer protection circles.

This policy shift could have major ripple effects for companies like Afterpay, Klarna, and Affirm—but also for homeowners in Florida and across the U.S. who rely on flexible financing options for large purchases.

This change marks a major policy reversal—and it could have a ripple effect across many industries, including home services like HVAC.

But what does this mean for Florida homeowners looking for no credit check HVAC financing?

Let’s unpack the decision, how it relates to CoolNow™, and what it means for your options if you need a new air conditioner in a tough economy.

At CoolNow™, we believe in empowering homeowners with honest, transparent, and flexible AC financing options—even in uncertain economic climates. In this article, we’ll break down:

✔️ What the CFPB change really means

✔️ How it might impact BNPL options for AC purchases

✔️ What Florida homeowners with bad or no credit can do to stay cool this summer

✔️ Your safest options in a changing regulatory landscape

What Is the CFPB and Why Does It Matter?

The CFPB is a government agency responsible for protecting consumers in the financial sector. Think of them as the watchdogs making sure your loans, credit cards, and payment plans are fair, transparent, and safe.

Under previous administrations, the CFPB was preparing to impose stricter regulations on BNPL services—those “split it into four payments” options you see on sites like Afterpay, Klarna, and Affirm.

The idea was to prevent predatory lending, ensure transparency, and avoid consumers taking on unregulated debt.

However, the Trump administration has shifted course. With the rollback of enforcement, BNPL providers are no longer held to the same consumer protections as traditional lenders.

💬 “Requiring BNPL providers to comply with rules designed for open-end credit cards creates compliance challenges and confusing outcomes for consumers,”

Affirm wrote in a formal comment letter, urging the CFPB to adopt rules that reflect how consumers actually use BNPL products, according this article from CNBC.

What the CFPB Change Means in Plain English

Under the Trump administration, the CFPB has signaled a rollback of many Obama- and Biden-era consumer protections. One of the most significant changes now involves the BNPL sector.

Until recently, BNPL companies were expected to operate like traditional lenders—meaning they had to provide disclosures, dispute resolution, and fair lending practices under the Truth in Lending Act.

Now? They’re largely on their own. According to the CFPB’s new interpretation, BNPL isn’t credit—it’s a short-term loan or installment agreement outside typical regulatory frameworks.

This means:

No federal oversight on lending terms

No required consumer disclosures

Limited recourse if a borrower feels misled

In short: more freedom for lenders, more risk for consumers.

But..How This Connects to HVAC Financing?

At first glance, you might think: What does a shopping app have to do with my air conditioner?

The answer: A lot more than you think.

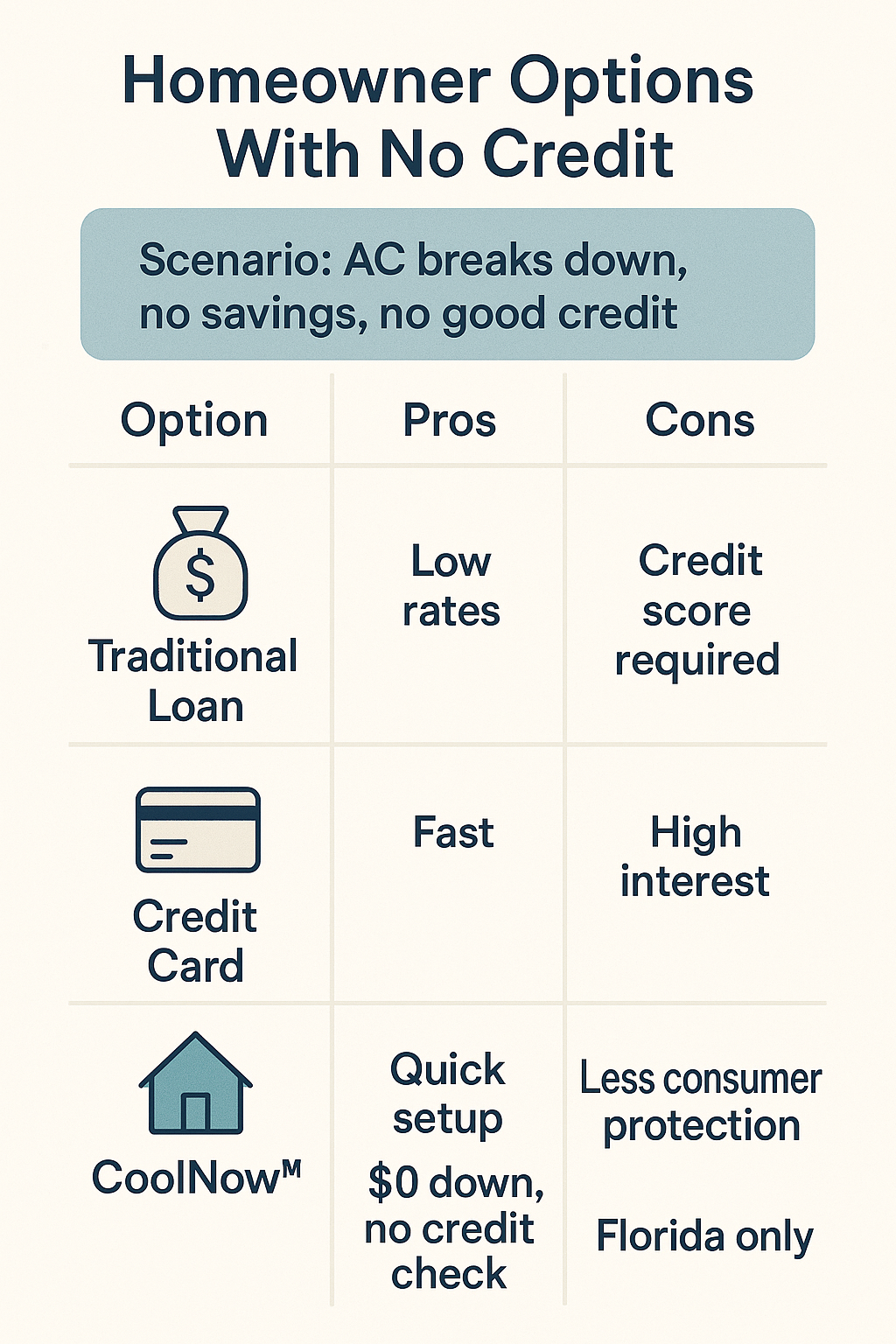

Many modern HVAC financing options—especially no credit check or soft-check plans—use BNPL-like models to offer flexibility to homeowners who don’t qualify for traditional loans.

Here’s how:

✔️ Fast approvals with limited or no credit checks

✔️ Short-term installment plans

✔️Non-bank financial partnerships with tech lenders

So changes in BNPL regulation—or lack thereof—can change how HVAC financing is structured, managed, and protected.

AC systems aren’t optional in Florida—they’re survival tools. But they’re also expensive, ranging from $6,000 to $15,000+ depending on the home and system type.

In a hot housing market with rising equipment costs and inflation pressure, more homeowners are leaning on financing options. BNPL services offered an appealing alternative to traditional financing—quick approvals, no hard credit checks, and flexible terms.

But now, with looser regulations and declining consumer protections, many HVAC contractors and homeowners alike are rethinking their trust in Buy Now Pay Later.

What Homeowners Should Watch For?

As BNPL services operate with fewer regulations, consumers may face:

1. Fewer Protections Against Hidden Fees

Without strict oversight, some providers might slip in service fees, prepayment penalties, or rate hikes buried in the fine print.

What CoolNow™ does differently: We pride ourselves on transparent pricing, $0 down options, and no hidden costs.

2. Less Clarity on Terms

BNPL contracts are sometimes vague or overly complex, making it harder to compare terms or know your rights.

Our promise: Every CoolNow™ financing plan is clearly laid out. We’re licensed HVAC pros, not middlemen.

3. Increased Risk of Data Misuse

Some fintech BNPL companies use your data in ways that traditional lenders cannot—because they’re not being held to the same standards.

With CoolNow™: We never sell or misuse your data. We only use the minimum info required to qualify you.

4. Higher Approval Barriers for BNPL Alternatives

If larger financial institutions pull back on riskier lending, even flexible financing options might become harder to access.

5. Credit Reporting Gaps

Most BNPL lenders still don’t report to credit bureaus—which can be good or bad. On the one hand, your credit score won’t be impacted; on the other, your on-time payments won’t help build your credit.

6. No Dispute Process

Unlike credit cards, most BNPL platforms don’t offer consumer protections if a product is faulty or the service isn’t delivered. If your HVAC install goes wrong with a third-party lender, you might be stuck footing the bill anyway.

What This Means for CoolNow™ Customers?

If you’re a homeowner in Florida considering a new AC system, here’s the bottom line:

-

The BNPL landscape just got riskier.

-

Your best bet? Stick with licensed, transparent providers who specialize in HVAC.

-

CoolNow™ offers a no-credit-check, $0 down path to get a reliable AC system—installed fast and backed by full warranties.

Will This Affect CoolNow’s Financing Options?

For now—NO. Here’s why:

✅ CoolNow™ is not a fintech BNPL startup. We’re a licensed HVAC contractor offering custom HVAC financing built for Florida homeowners.

✅ Our financing model relies on partnerships with vetted, consumer-first financial providers.

✅ We already follow high standards of transparency, fair terms, and secure data handling—regardless of federal enforcement levels.

In short: we’re already doing what’s right. The rollback of enforcement doesn’t change our commitment to ethical HVAC financing.

Florida Homeowners & Credit: A Tough Combo in 2025

According to Experian’s 2024 Credit Trends Report:

📉 Florida ranks among the top 10 states with the highest percentage of subprime credit scores (scores below 580)

💳 32% of Orlando homeowners say they’ve delayed a major home improvement due to credit concerns

💡 Over 70% of Americans say they’d choose BNPL over credit cards if given the option, according to a LendingTree study in late 2024

But with reduced protections, many homeowners are asking: Is it worth the risk?

So What Should You Do If You Need a New AC System?

The economy is shaky, inflation is high, and AC systems aren’t getting cheaper.

Here’s what Florida homeowners should do in 2025:

🔍 Research Providers Carefully

Make sure any company offering no credit check HVAC financing is transparent, local, and licensed. Don’t fall for out-of-state platforms with flashy ads but no accountability.

💳 Understand the Terms

Ask questions like:

✔️ Is there a prepayment penalty?

✔️ Are payments fixed or variable?

✔️ What happens if I miss a payment?

✅ Choose a Company That Puts Homeowners First

CoolNow™ was built for this economy. We help people with limited credit—not punish them for it.

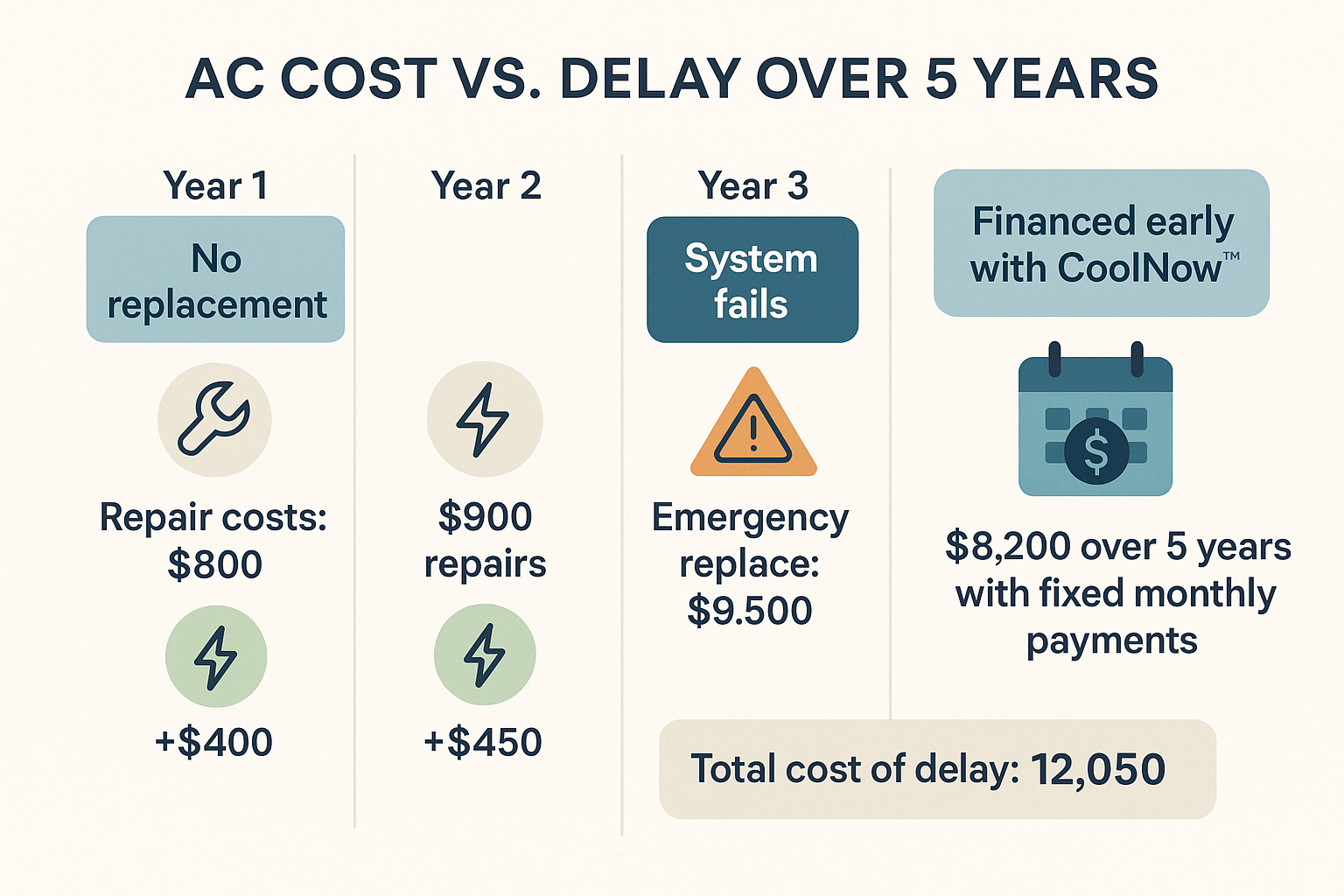

Real Data: The Rising Cost of Doing Nothing

Putting off an AC replacement doesn’t save money—it adds risk. Here’s why:

📉 Energy Inefficiency

Older systems can consume 30–50% more electricity than modern SEER2-compliant units. (Source)

🛠️ Emergency Repair Costs

The average emergency AC repair in Florida costs $550–$1,200. Two or three repairs quickly add up to more than a new system.

🔥 Heat-Related Health Risks

A study by the CDC shows that heat-related illnesses are rising in southern states. Florida had over 3,000 emergency room visits linked to extreme heat in 2023 alone. (CDC)

💬“We’re seeing more families delay AC replacement due to cost—even though their units are barely working,” says Luis Arias, AC contractor in Orlando.

Final Thoughts: Stay Cool Without Getting Burned

The CFPB’s policy rollback might weaken some guardrails—but it doesn’t change what matters most: trust.

With CoolNow™, Florida homeowners can still access no credit check HVAC financing that’s fair, fast, and honest.

We’re not here to capitalize on a legal loophole—we’re here to make air conditioning accessible to families who need it most.

If your AC system is failing, don’t wait until the heat gets dangerous.

👉 Visit CoolNowACFinancing.com to apply in minutes and get installed as early as tomorrow.

Stay cool, Florida. You’ve got options.